Travel expenses in 1s 8.3 accounting per diem. Accounting info. Documentation of business trips

The employee must be given money before the business trip. An advance can be issued from the cash register or funds can be transferred to the employee’s personal bank account. At the same time, in 1C 8.3 financial documents are drawn up in the Bank and Cash Department section:

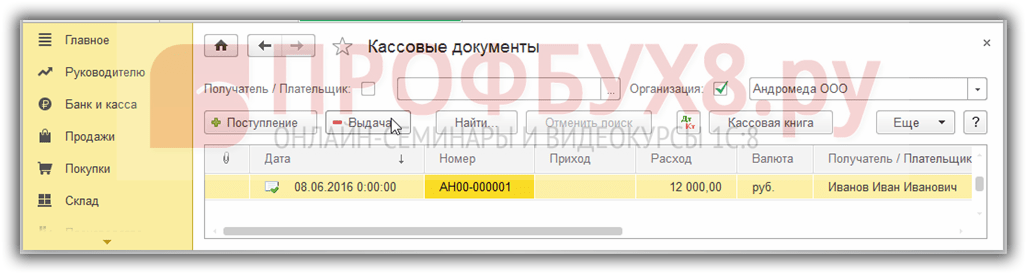

In cash documents you need to add a document using the Issue button:

Let's move on to filling out the cash document. The type of transaction must be specified Issue to the accountable person:

- The number and date in 1C 8.3 are automatically set when posting a document, but can be adjusted manually;

- The recipient is a business traveler.

Details of the printed form:

- By document – employee ID data from the Individuals directory is automatically displayed;

- Reason - for what needs the funds were issued;

- Appendix – document – basis for issuing funds:

Important! Since 2012, funds for business trips are issued on the basis of an application in any form.

Enter the employee's ID data from the Individuals directory:

If you specify for the DDS item in the Cash Flow Items directory that it is used by default in transactions for issuing accountable amounts, then the DDS item in the Cash Withdrawal document will be entered automatically:

The movements of the document (posting) for issuing cash to an accountable person are standard:

A cash outgoing order in the KO2 form can be opened by clicking the Print button. Using the Print command, you can print the standard form Cash receipt order (KO2).

If Client-Bank is not used

- The type of transaction must be indicated – Transfer to an accountable person;

- Employee – business traveler;

- Recipient – you must indicate the Employee or the Bank, depending on how exactly the funds are transferred, through the bank or directly to the employee’s current account;

- Check the Paid box.

The document Write-off from a current account in 1C 8.3 is generated via Enter a document written off from a current account:

If Client-Bank is used

Document movements Debit from current account are generated only after checking the box Confirmed by bank statement:

How to arrange a business trip in 1C 8.3

Upon returning from a business trip and returning to work, the employee is required to report on travel expenses within three working days.

Reimbursable travel expenses:

- Travel expenses;

- Housing rental expenses;

- Daily expenses;

- Other expenses, confirmed and economically justified.

How to fill out an advance report in 1C 8.3

To reflect travel expenses. The journal of advance reports is located on the Bank and cash desk - Advance reports tab:

An advance report in 1C 8.3 can be created from the Advance reports journal using the Create button:

- The reporting person is a posted employee;

- Purpose – indicate for what needs the funds were issued;

- Attachment of __ documents on __ sheets – the number of documents and their sheets attached to the expense report;

- In the Advances table we enter all the documents for which the employee is accountable using the Add command;

- Using the selection button, go to the required type of documents;

- Travel expenses are filled in on the Other tab;

- If during a business trip an employee purchased goods, packaging, or made a payment to a supplier, then these expenses are indicated on the Products, Returnable packaging and Payment tabs, respectively:

Important! You do not need to provide any documents to confirm your daily allowance expenses. For other expenses, you must have supporting documents (receipts).

If the payment is made by non-cash funds, then there must be confirmation of payment by a personal bank card, which displays the last name of the traveler.

In the Other tabular section, you must enter all the data from the reporting documents provided by the employee:

- The “SF” checkbox is set to register a received invoice or BSO, where VAT is allocated as a separate amount, for example, tickets. If VAT is not allocated, then the entire amount is included in expenses and there is no need to check the “SF” checkbox.

- The “BSO” checkbox (strict reporting form) is checked if it is necessary to register a BSO, according to which VAT is deducted and displayed in the Purchase Book.

The invoice received is generated automatically based on the data in the Invoice details column:

and is displayed in the Purchase Book:

Features of working with accountable persons in 1C 8.2 (8.3), how to correctly fill out the Advance report are discussed in the following video:

Accounting for travel expenses in 1C 8.3

You can check the status of settlements with a traveler in 1C 8.3 using the Account balance sheet report:

Using this report in 1C 8.3, you can reconcile mutual settlements with an employee for travel expenses, as well as for all accountable amounts:

Return of unused funds

To return unused funds issued for travel expenses, in 1C 8.3 it is necessary to create a Cash Receipt document based on the advance report:

In the created document you need to check the data:

How to arrange a business trip and pay travel allowances in the 1C 8.3 Accounting program?

Sending an enterprise employee on a business trip begins with an order from the director. The employee is informed about this, and if an agreement is reached, the order is transferred to the accounting department (the order of operations at different enterprises may be different).

The accounting department issues a travel certificate (based on the director’s order). These documents are not prepared in the standard configuration of 1C 8.3 “Enterprise Accounting 3.0”.

In the 1C program, registration of a business trip begins with the issuance of money and reporting.

Issuing travel allowances in 1C 8.3

As a rule, money is issued from the cash register. In this case, the issuance is issued by a “Cash Expenditure Order“. Although, especially recently, funds can be transferred by bank transfer to an employee’s card. In this case, a document “Write-off from the current account” is created.

The amount is initially calculated approximately based on expected expenses:

- travel

- accommodation

- daily allowance

- other

To receive funds, the employee must write a statement indicating the amount and purpose of the expenses. In our case, these are travel expenses.

Let's consider the registration of an advance payment using the example of a “Cash outgoing order”.

You immediately need to set the type of issue (type of transaction) to “Accountable person”. Then fill in the details:

- organization (if there are several of them in the database)

- recipient

- sum

- In the transcript of the details of the printed form, indicate the employee’s application number

In the comment you can indicate that this is an advance payment for a business trip:

Now you can post the document and see the postings for the issuance of travel allowances, which 1C Accounting 8.3 will generate:

The employee has incurred a debt for which he must account.

Employee report for travel expenses

Upon returning from a business trip, the employee is required to account for the money spent. For this purpose, in 1C 8.3 the document “Advance report” is used.

An “Advance report” is created in the same section as “Cash documents”.

In the list form, click the “Create” button. A new document form will open.

First of all, we choose an accountable person. Then, on the “Advances” tab, click the “Add” button and in the “Advance document” column, select the expense order issued earlier (a window will first open where you need to select what type of document we need):

Then go to the “Other” tab and fill in the lines there where the employee’s expenses went. If funds were used to purchase goods, these transactions should be reflected on the “Goods” tab.

An example of filling out the “Other” tab:

If we post the document and look at the postings, we will see that the company’s debt to the employee has decreased by 2,000 rubles:

Since the expenses have already been paid, they immediately go into the Book of Income and Expenses of the simplified tax system:

Based on materials from: programmist1s.ru

One of the most common cases when employees at an enterprise are paid an average salary is when the employee is on a business trip. Each business trip is formalized by an order indicating the employee’s last name, first name, and patronymic; where is he going; purpose of the trip; period of being on a business trip. The period of stay is paid to the employee in accordance with the Labor Code (hereinafter referred to as the Labor Code) of the Russian Federation. In this article I want to clearly examine the topic of how to arrange a business trip for an employee in the 1C program.

Setting up a salary block in the 1C program

In order to pay salaries to employees, it is necessary to correctly configure the payroll accounting parameters. To do this, you need to log into the program as an employee who will set the necessary parameters with “Administrator” rights. In the main menu, open the “Salary and Personnel” section, then in the “Directories and Settings” block, find the “Salary Settings” item.

It is correct to establish in it, in accordance with the Labor Code of the Russian Federation and the Regulations on Remuneration of Labor, all the necessary parameters. If in the 1C program you do not find a document for accruing a business trip, then you need to create it; it will calculate the average earnings if the employee is on a business trip.

A document for calculating average earnings, when an employee is on a business trip, can be created by an accounting specialist; it is not so difficult, and it will not take much time.

To do this, go to the settings, to the “Accrual” block to create a document.

Click on the “Create” button, a window opens on the monitor screen in which you need to fill in (select, set a feature) the following positions:

Click on the “Create” button, a window opens on the monitor screen in which you need to fill in (select, set a feature) the following positions:

- Name;

- personal income tax;

- Insurance premiums;

- Income tax;

- Reflection in accounting;

- Included in the basic accruals for calculating the “Regional coefficient” and “Northern surcharge” accruals.

In field:

In field:

- “Name” can be written “Payment based on average earnings when the employee is on a business trip”;

- “Personal income tax”, set the “Taxed” attribute, indicating the “Income code”;

- “Insurance premiums”, select the type of income “Income entirely subject to insurance premiums”;

- “Income tax”, set the attribute “Accounted for as part of labor costs” and select the expense attribution item;

- “Reflection in accounting” select the method of reflection.

After that, click on the button:

After that, click on the button:

- “Record and close”;

- Or "Record".

Only after this can you calculate the average earnings while the employee is on a business trip

Maintaining average earnings while an employee is on a business trip in the 1C program

To draw up a document in 1C that would allow us to calculate the average earnings during a business trip, we need to go to the main menu, section “Salaries and Personnel”, select the “Salary” block, and in it the position “All accruals”. A journal will appear on the screen, in which all accruals for employees for previous periods will appear. We create an accrual for the current month, to do this, click on the “Create” button and select the “Salary accrual” position.

In the accrual document, you must fill in the following fields in the document header:

In the accrual document, you must fill in the following fields in the document header:

- Month of accrual;

- Organization;

- Subdivision.

Going to the tabular part of the document, open the “Accrual” tab. From the directory, select the employee and the type of accrual that you created earlier, “Payment based on average earnings when the employee is on a business trip,” enter the days of the business trip, the hours, and display the result. Afterwards we carry out the document by clicking on the “Post” button and close it.

You can create payroll documents for each employee of the organization or for all employees. Then to do this you need to click on the “Fill” button.

It is necessary to remember that arranging a business trip for an employee is associated not only with calculating average earnings, but also with documenting the employee’s assignment on a business trip, with the issuance of funds for reporting, with the preparation of an advance report, with the return of funds, and others.

It is necessary to remember that arranging a business trip for an employee is associated not only with calculating average earnings, but also with documenting the employee’s assignment on a business trip, with the issuance of funds for reporting, with the preparation of an advance report, with the return of funds, and others.

In today's article we will touch on the topic of arranging business trips to 1C Salary and personnel management 8.3. As always, we will show you step-by-step instructions for working in the program, and if you still have questions about business trips in 1C 8.3, you can leave them in the comments to the article. Next we will consider the following questions:

1. Open the “Business Trips” subsection

Open the program, in the “Salary” section, go to “Business trips”.

Important! In order for the “Business Trips” position to be active, you need to check the corresponding box in the initial settings for calculating salary.

2. List of documents

In the “Travel Salary” section, you will see a form for a list of documents.

3. Create a document

Look, the program for creating a document has 2 buttons. Clicking the 1st button creates a document for calculating travel payments for the 1st employee.

4. Calculation of average earnings

You need to indicate the month in which the calculation will be recorded. The program defaults to the current month. We open the “Employee” directory and select the one we need.

Next, you need to indicate the start and end of the business trip. If you have a staffing table in your program, then you can release the rate during the employee’s absence by checking the appropriate box. Wed. The program will calculate your earnings and accrual for a business trip automatically.

In case the business trip ends on the following day. month, the 1C ZUP 8 program helps you plan payment in full or for each month. If you choose monthly payment, then with this document you provide payment only for the current month. As for the calculation of payment for other months, it will be carried out when calculating the salary. Further, the average earnings for such calculations will correspond to the value obtained in the “Business trip” document.

5. How to calculate daily allowance for a business trip

To view the detailed calculation, go to the “Accrued (detailed)” tab.

6. Special territorial conditions

If an employee is sent to special territorial conditions, then on the “PFR Experience” tab you need to fill out the “Territorial conditions” column.

7. Print

To display the printed form, you first need to fill out the “Advanced” tab. On this tab you need to fill in the following data: place of business trip, number of days, basis, purpose and financing of the trip.

8. How to spend a business trip

When all the necessary data is filled in, we submit the document. In addition, on the basis of this document, you can print a business trip order, all calculations, travel certificate and official assignment (the last 2 points are not required to be completed since 2015).

9. Combination of positions

If your company practices combining positions (and this is indicated in the 1C ZUP 8 program), then using the document “Business trip” you can create a document “Combination of positions”. This will allow you to assign an additional payment to the employee who will perform the work duties of the one who went on a business trip.

10. Part-time job

Or there may be a situation where an employee who went on a business trip has a part-time job. A hyperlink is placed in the document, which allows you to document its absence.

11. Payment of travel allowances

If you choose payment during the inter-settlement period, you can carry out this operation by clicking the “Pay” button. In other cases, the payment is made together with the salary.

12. Calculation of deductions

If you select this payout option, deductions will be calculated. The same thing will happen with the “With Advance” payment type. To view the details of calculation and deductions, click on the “pencil” in the right corner.

13. Business trip order

Using the “T-9a” button, we proceed to generating a business trip order for several employees at once.

14. Creating a timesheet

Filling out the document is done using the “Add” button. When adding information to the tabular part of the document in the last column “Accounting for absences and accruals”, the data will be displayed as a hyperlink. In the above example, absences for the 1st employee are taken into account. since the “Business trip” document has already been added for him, but not yet for the 2nd employee. Thus, it turns out that it is necessary to draw up a separate “Business Trip” document for each posted employee.

15. Payment for days off on a business trip

If the business trip falls on a weekend and the employee was working, then it is necessary to enter information in the document “Payment for holidays and weekends.” Working days that an employee spent on a business trip are indicated in the timesheet by the letter “K”.

On the main tab of the “Business trip” document, you can check the box next to the item about intra-shift business trip. This will allow you to enter information about your part-time travel assignment.

Part-time business trip (intra-shift)

In the accounting sheet it will look like this:

Thus, you have processed and calculated the payment for an employee sent on a business trip and reflected it in the 1C ZUP program.